FINAL EXAM PRACTICE QUESTIONS:

Most of the practice questions below are identical to selected review and analytical questions at the end of each chapter.

1. Give 4 different types of risk and examples of financial instruments designed to minimize each of these types of risk.

2. What is moral hazard? Why does deposit insurance inherently involve moral hazard? What factors contribute to moral hazard on the international level?

3. What are off-balance-sheet items? Give some examples. How can they contribute to the fragility of the financial system?

4. There are two methods of resolving a bank. What are they? Which has been the preferred method?

5. If all prices and your income fall by 25 percent, by what percent does the real value of your debt increase?

6. Assume that a bank has the following:

-

Stock issued $15,000,000

-

Retained earnings $2,750,000

-

Loan-loss reserves $2,600,000

-

Subordinated debt $5,000,000

-

-

What is its core capital? What is its total capital?

7. What is a financial conglomerate? Discuss the factors that contribute to the formation of financial conglomerates.

8. A mutual fund owns stocks with a market value of $1 billion and has liabilities of $1 million. What is the net asset value? If there are 2 million shares of stock outstanding, what is the net asset value per share?

9. What is buying on the margin? Does it increase or decrease the risk of large losses? What about gains?

10. If a share of stock pays a dividend of $3 and closes today at $36, what is the current yield?

11. If I bought $10,000 worth of stock by putting up 60 percent of the selling price and borrowing the rest, how much have I borrowed? If the stock falls to $3,000 and a margin call is put in for the difference between the value of the stock and the amount I have borrowed, how much will I have to put up?

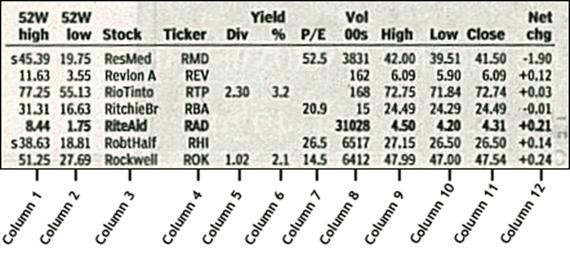

12. Interpret the items in the bolded line in this table (stock: RiteAid):

13. Jessie has bought a share of stock for $100. She has borrowed $50 from her broker. There is a 25 percent maintenance margin requirement established by the brokerage firm she does business with. The price of the stock falls to $80. Will her broker put in a margin call to her asking her to put up more funds? If so, how much? What if the price falls to $50? In each case, if so, how much more? (Ch 16, analytical question 22)

14. Interpret the last line in this table (bond: Coke):

15. What are debenture bonds and subordinated debenture bonds. Which of their characteristic is analogous to preferred and common stocks

16. What are government agency securities? Are they backed by the full faith and credit of the U.S. government? Give examples.

17. Define financial futures, forward agreements, and options. What are the advantages and disadvantages of each?

18. Explain the difference between call and put options. Does the buyer or the seller of an option pay the option premium? Why does the seller of an option take on the risk?

19. What factors determine the size of the option premium?

20. A firm buys a December $100,000 Treasury bond call option with a strike price of 110. If the spot price in December is $108,000, is the option exercised? What if the strike price is 105?

21. A firm buys a December $100,000 Treasury bond put option with a strike price of 110. If the spot price in December is $108,000, is the option exercised? What if the strike price is 105?

22. A brokerage house purchases an S&P 500 futures agreement for $300,000. On the delivery date, the S&P 500 Index is 575. Does the brokerage house make a profit? What if the S&P 500 is 625?

23. There are 8 different types of exchange rate regimes (if you classify Monetary Unions as a separate category, there are 9). Briefly explain what these are, starting from the most restrictive to the least restrictive type of exchange rate arrangement.

24. Briefly explain the Bretton Woods exchange rate system. When was is created and why? Why did the system collapse?

25. What are the advantages and disadvantages of fixed exchange rate regimes?

26. Explain the importance of foreign exchange reserves for the operation of the following exchange rate regimes: Managed float, standard peg, currency board and a monetary union.

27. What are the key differences for implementing fiscal policy under a managed float, fixed exchange rate system, currency board and the European Union.

28. There are 8 different types of exchange rate regimes. What are they? (list them and provide a brief description)

29. Use the supply-demand diagram for foreign exchange to explain how the monetary authority of a country operating under a pegged exchange rate would intervene in order to prevent an appreciation or depreciation in the domestic currency. (Begin with an example of the conditions, which would bring about an appreciation or depreciation of the domestic currency.)

30. in the European Monetary Union we observe a severing of the link between the monetary and fiscal authority. Explain the nature of this 'divorce' and its implications for implementing policy.